🫶 Understanding the User

The Challenge

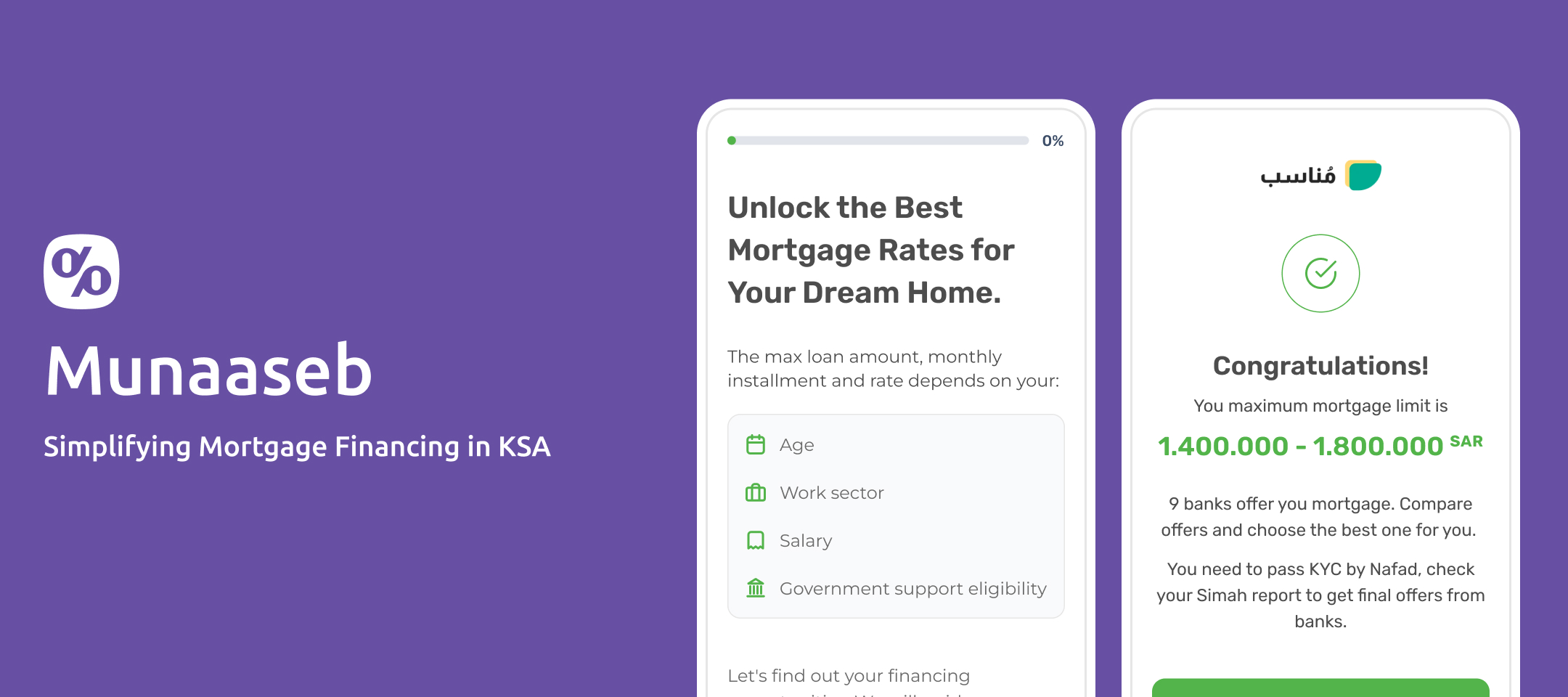

In Saudi Arabia, individuals seeking mortgage financing face multiple challenges, including limited access to clear information, inefficient application processes, and a lack of personalized solutions. Many struggle to find financing options suited to their unique needs and often encounter complex, paper-heavy workflows. Munaaseb addresses these challenges by providing a streamlined digital platform that simplifies the mortgage application process and offers tailored financing options based on users' profiles.

The Discovery

For Munaaseb’s discovery phase, we concentrated on understanding the pain points of users in the

mortgage financing landscape through market research and stakeholder meetings. We

reviewed existing mortgage platforms and analyzed competitor strategies to pinpoint gaps in user

experience. Additionally, we conducted surveys to gain direct feedback from potential users,

focusing on their needs for a streamlined mortgage process.

To further refine our approach, we created a sitemap, defined key Jobs to Be Done (JTBD), and

developed personas to guide the platform's design and functionality.

Competitive Audit

For Munaaseb, we conducted a detailed competitive audit to evaluate the mortgage financing

landscape. By analyzing both direct and indirect competitors, we gained valuable insights into

their strategies, strengths, and weaknesses. This process helped us identify gaps in the market

and refine Munaaseb’s unique value proposition. Our focus was on how competitors handle user

journeys, including eligibility assessments, mortgage calculator, and personalized mortgage

recommendations, ensuring Munaaseb would stand out in delivering an enhanced and user-friendly

mortgage financing experience.

My Medium article on competitive audits

helped guide our approach to analyzing the mortgage financing landscape, ensuring we stayed

focused on user-centered differentiation.

A summary of competitors’ key features and unique value propositions, providing insights to

refine Munaaseb’s mortgage solutions.

A summary of competitors’ key features and unique value propositions, providing insights to

refine Munaaseb’s mortgage solutions.

Survey

To understand users’ needs and behaviors in the mortgage financing space, we conducted a survey targeting potential homebuyers across Saudi Arabia. The survey covered user demographics, financial literacy, key challenges, and preferences related to obtaining mortgages.

The results revealed major challenges in finding suitable homes and understanding financial terms, with users expressing interest in tools that offer financial advice, clear mortgage comparisons, and flexible options. These insights helped shape the design and features of Munaaseb to better address these pain points and user needs.

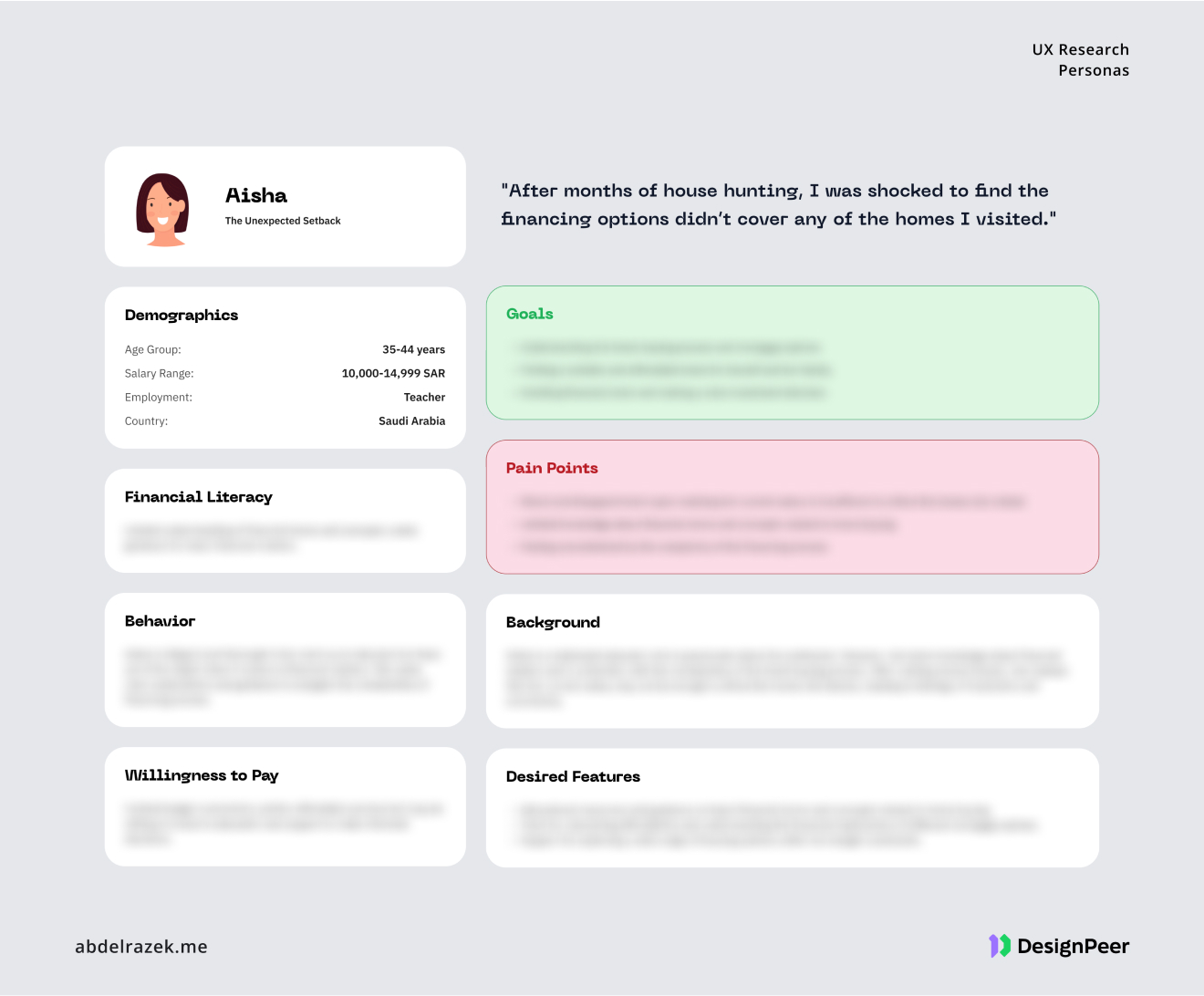

Persona

We identified several key personas to ensure the platform caters to different user profiles, each with unique goals, challenges, and financial literacy levels. These personas reflect the diverse backgrounds of potential mortgage applicants, from savvy buyers looking for the best deals to first-time homebuyers seeking guidance through a complex process. Through these personas, we aimed to tailor Munaaseb's features to address each user's specific needs, ensuring a user-centered approach that aligns with their financial goals and comfort with technology.

Munaaseb Persona, highlighting user needs, goals, and pain points in the mortgage financing

journey.

Munaaseb Persona, highlighting user needs, goals, and pain points in the mortgage financing

journey.

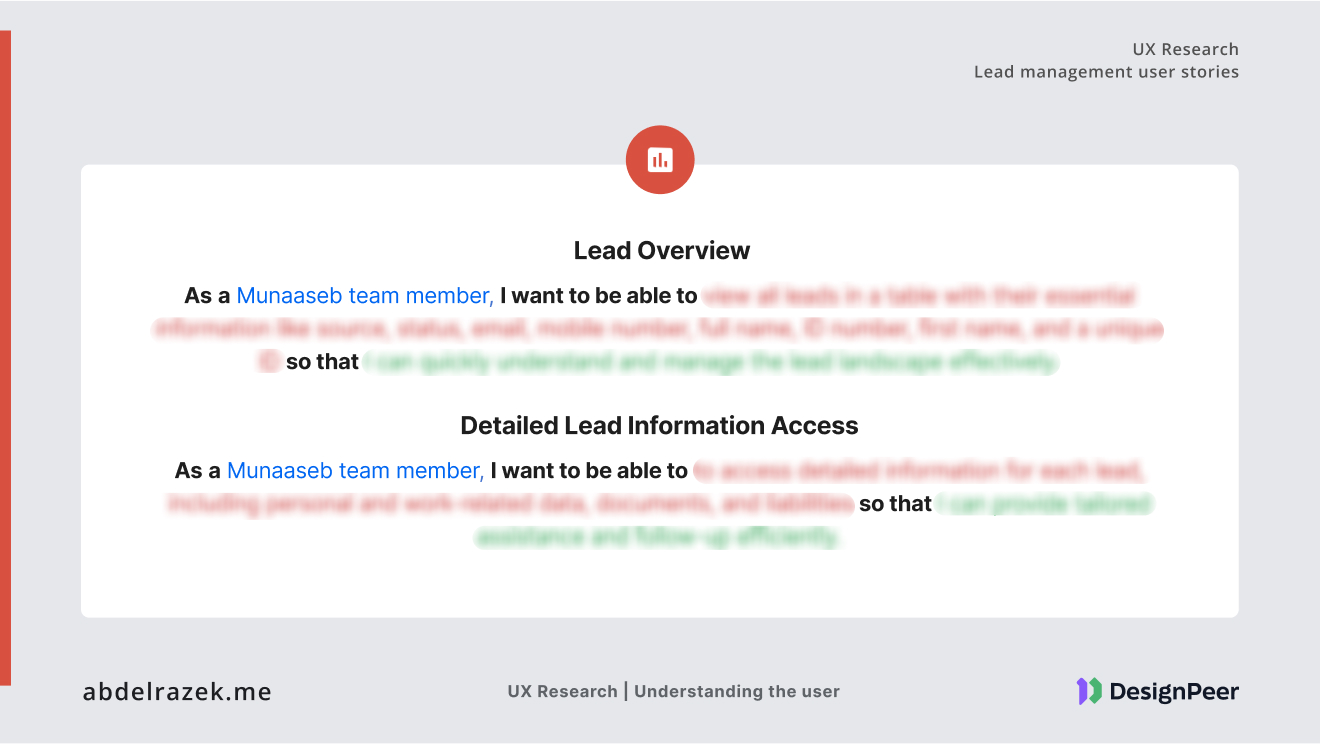

Jobs to Be Done (JTBD)

As part of the CRM system we designed for Munaaseb, we developed detailed Jobs to Be Done (JTBD) to guide the platform's functionality. This section highlights the essential tasks and features that the Munaaseb team relies on to manage leads, track applications, and deliver personalized mortgage solutions, ensuring a streamlined and efficient process for both team members and clients.

-

Key CRM Features Include:

- Lead Management: Organize leads, categorize them by attributes like work sector and salary, and dynamically update based on real-time data for effective targeting.

- Segmented Targeting: Create and manage lead segments using conditional logic, helping the team efficiently target specific audiences based on key criteria like age, employment, or work sector subsidies.

- Activity Log: Provide detailed logs of communications, financing applications, and document submissions, enabling team members to quickly access a lead’s complete history and status.

- Tailored Mortgage Solutions: Use an integrated calculator to generate personalized mortgage recommendations, allowing Munaaseb to offer financing options based on the specific needs of each lead, while also supporting personal, auto, and business financing.

- Application Management: Track all financing applications—mortgage, personal, auto, and business—through a centralized system that consolidates tasks, documents, and activities related to each application.

- Departmental Coordination: Seamlessly transfer lead files between departments for further review or processing, enhancing collaboration across Munaaseb’s internal teams.

- Reporting: Generate insights and performance metrics through reporting tools, giving Munaaseb visibility into the effectiveness of their outreach, application success rates, and other key metrics.

Sample JTBD illustrating the lead management process within Munaaseb’s CRM

Sample JTBD illustrating the lead management process within Munaaseb’s CRM

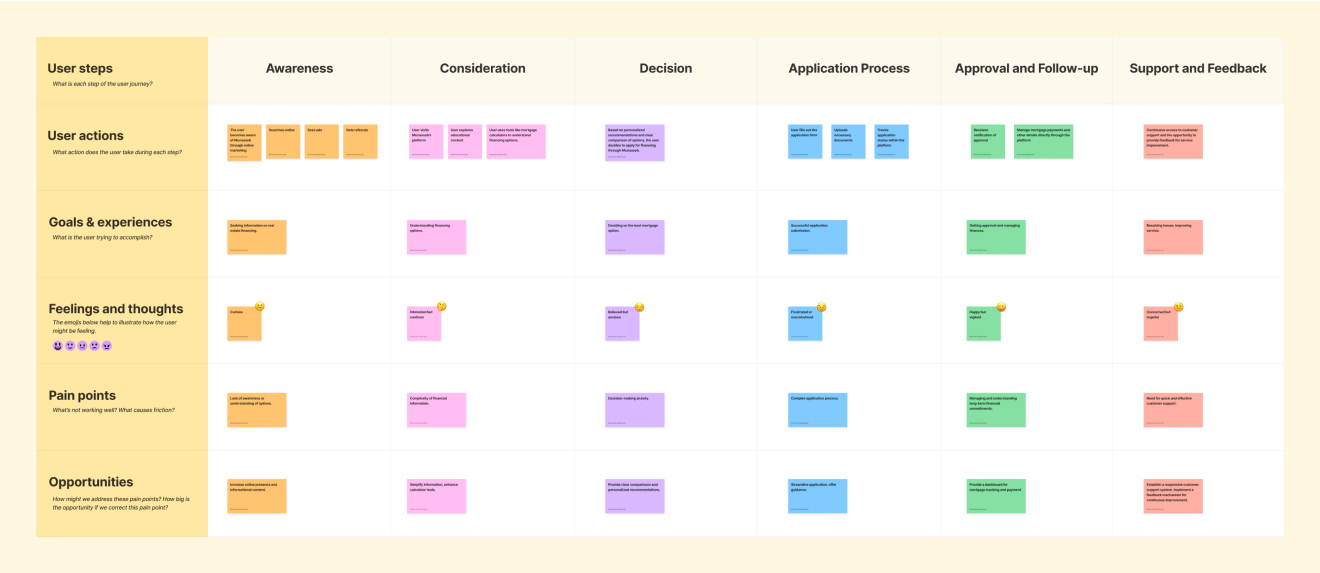

Journey Map

To understand the user's journey through the mortgage financing process, we mapped key stages from awareness to post-approval support. The journey highlights user actions, goals, emotions, and potential pain points. This insight allowed us to design a seamless experience tailored to user needs, reducing friction at critical touchpoints such as information gathering, application submission, and customer support. The journey map informed key design decisions to enhance the platform’s overall usability and satisfaction.

Journey map illustrating key stages in the mortgage financing journey, highlighting user

actions, emotions, and opportunities for Munaaseb to enhance the experience.

Journey map illustrating key stages in the mortgage financing journey, highlighting user

actions, emotions, and opportunities for Munaaseb to enhance the experience.

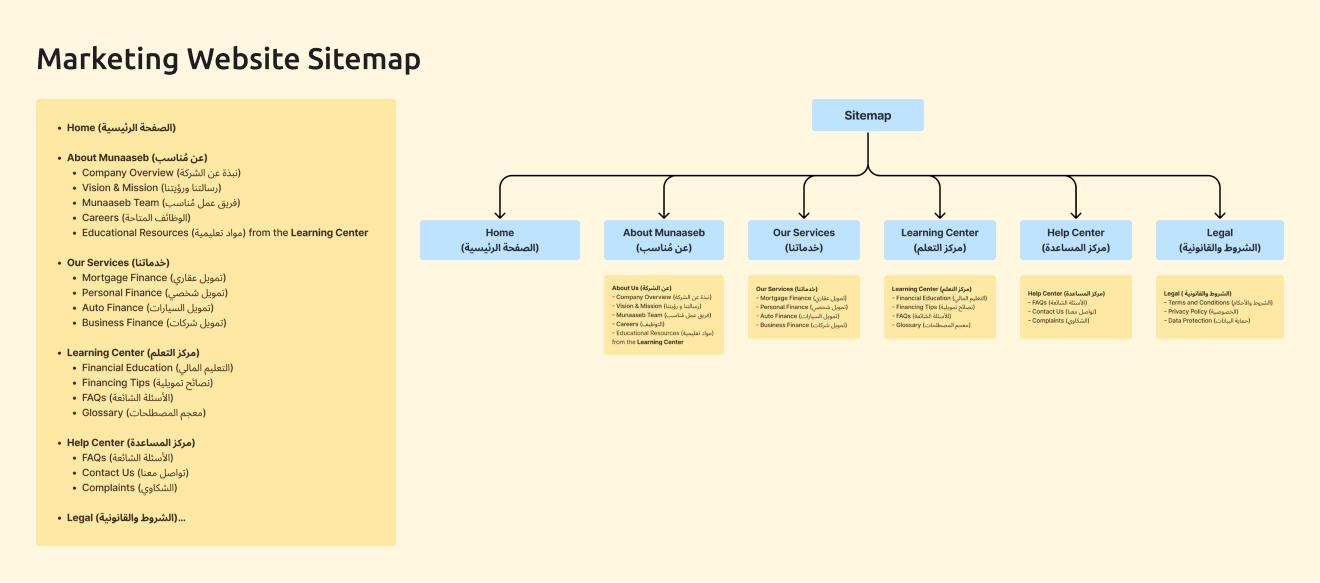

Information Architecture

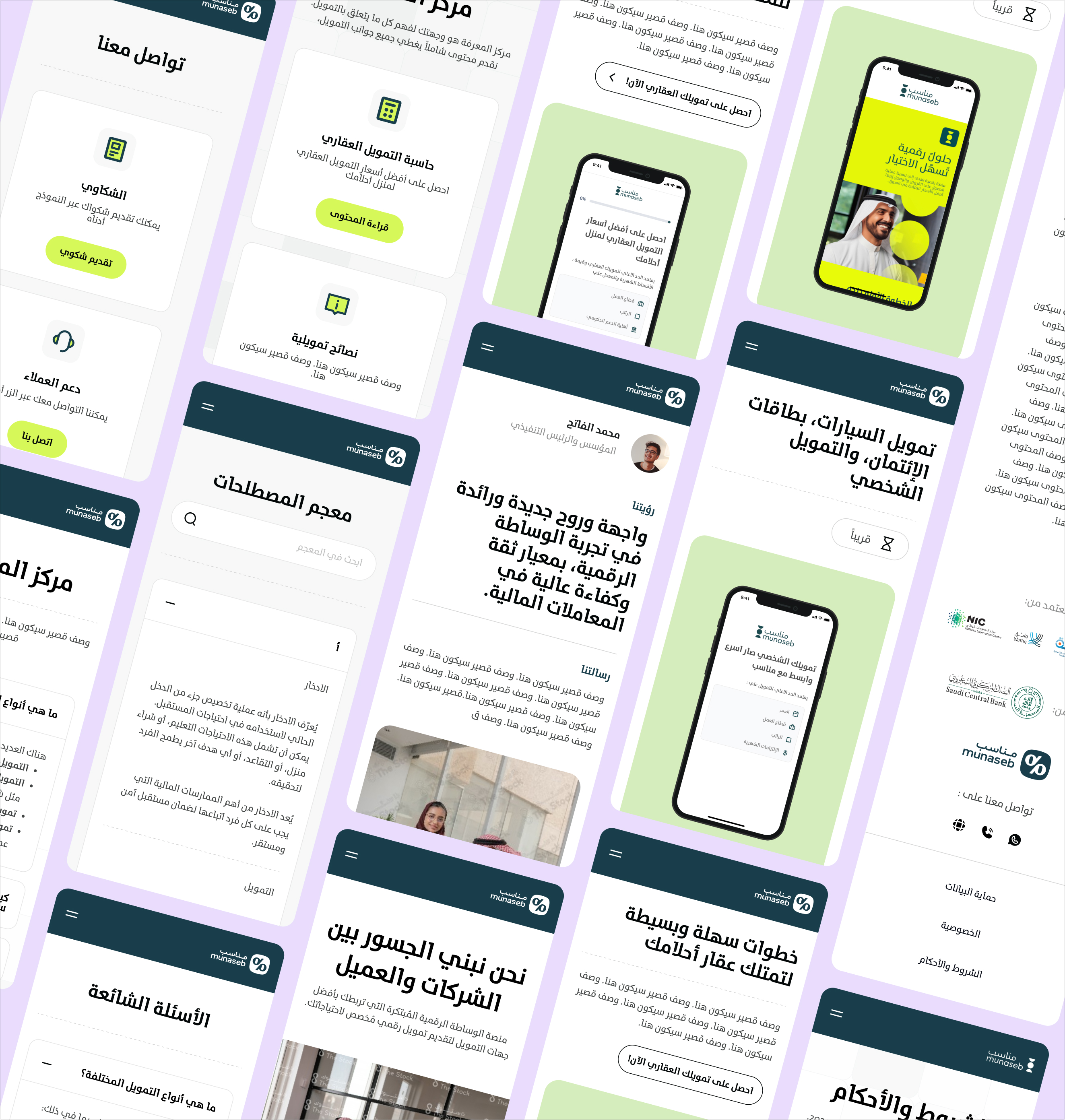

For Munaaseb's marketing website, we focused on structuring the content to provide a seamless user experience, allowing visitors to easily navigate and access key information. This was essential in guiding users through the mortgage financing process, from exploring eligibility assessments to engaging with personalized mortgage recommendations. Below is the sitemap designed to support Munaaseb’s goals of user engagement and lead generation, ensuring users have clear paths to find the tools and information they need.

Overview of Munaaseb’s marketing website structure, designed to guide users through services,

educational resources, and support options, providing a clear and accessible navigation

experience.

Overview of Munaaseb’s marketing website structure, designed to guide users through services,

educational resources, and support options, providing a clear and accessible navigation

experience.

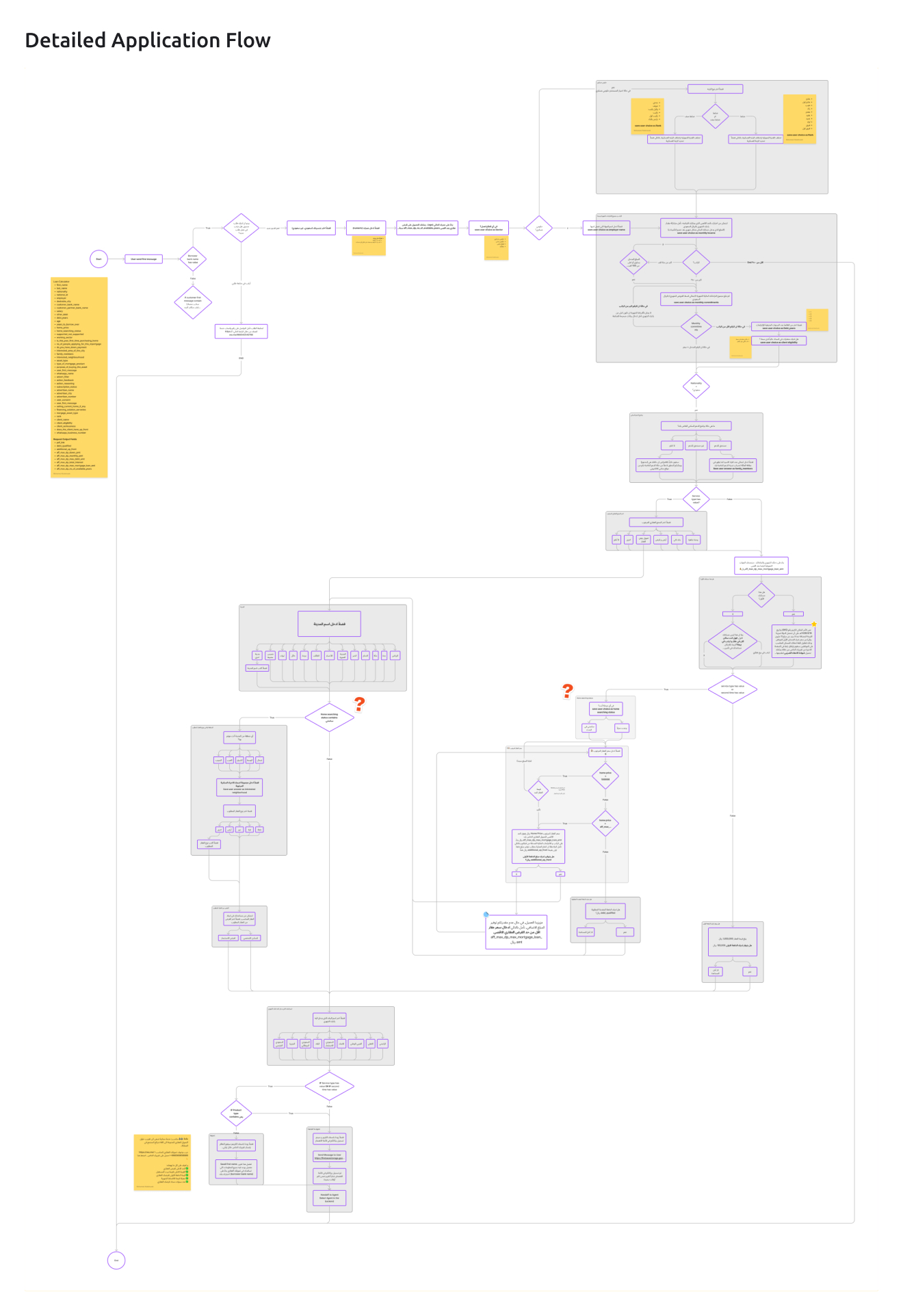

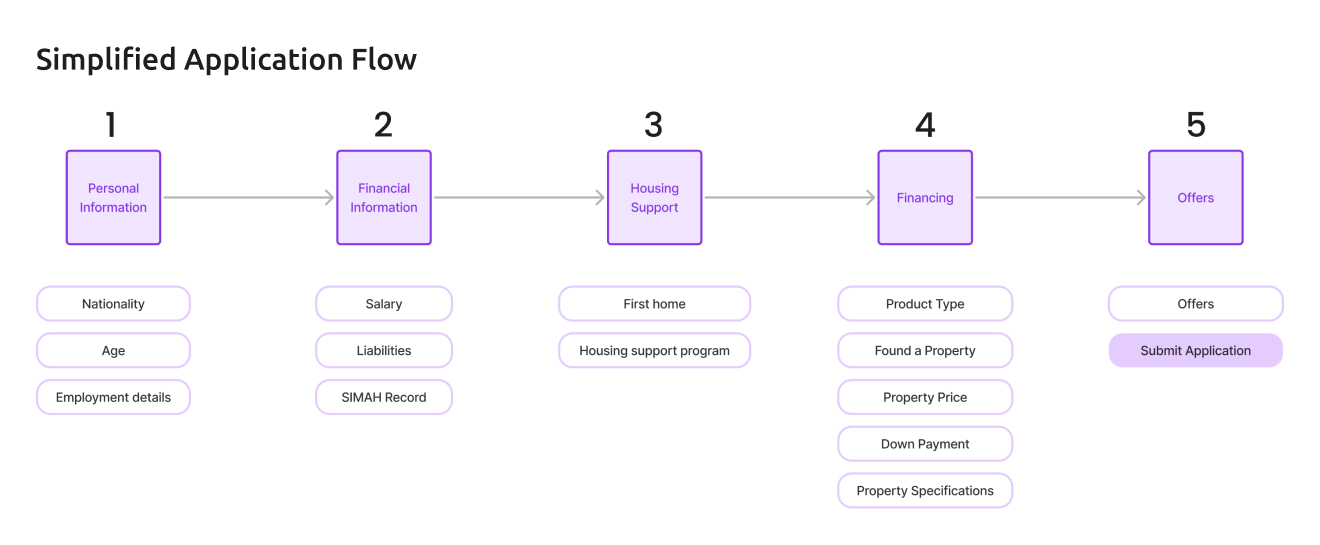

Key User Flows

To ensure a smooth and intuitive experience for users on Munaaseb’s platform, we designed key user flows that simplify the mortgage application process. This flow covers five essential stages:

- Personal Information: Nationality, age, and employment details.

- Financial Information: Salary, liabilities, and SIMAH record.

- Housing Support: First home and housing program eligibility.

- Financing: Product type, property details, and down payment.

- Offers: Tailored mortgage offers, then submit the application.

Each stage was developed to minimize friction and enhance user clarity from start to finish.

📱 Design

CRM Segments Wireframes (Sample)

Aqar Iframe on Desktop (Sample)

Aqar Iframe on Mobile (Sample)

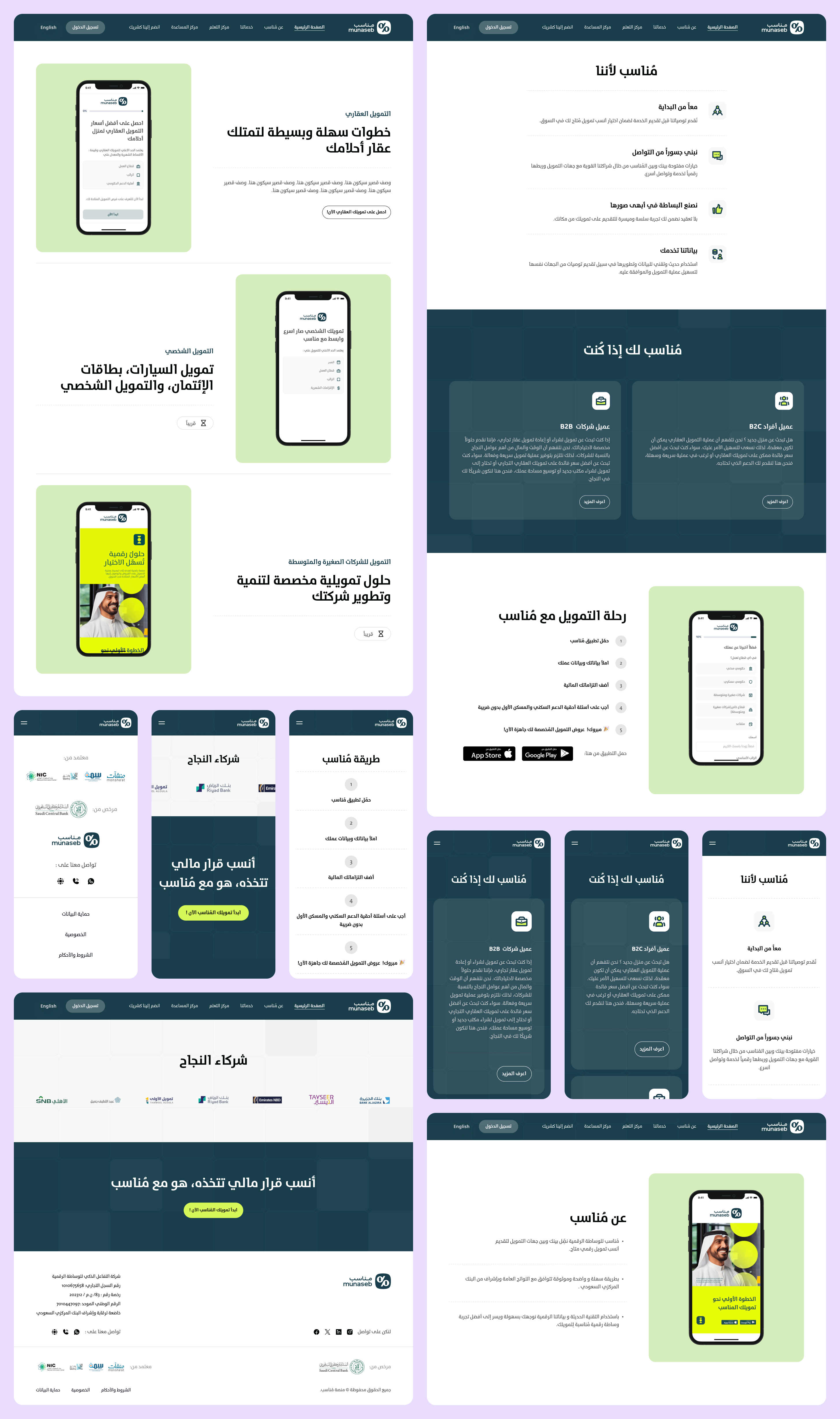

Marketing Website Homepage 1

Marketing Website Homepage 2

About Munaaseb, Help and Learning Center